15 yr refi rates overview for smart borrowers

What a 15-year refinance means

A 15-year refinance replaces your current mortgage with a shorter term, often at a lower interest rate than a 30-year loan. Monthly payments are typically higher, but total interest paid can drop dramatically, building equity faster and shortening your payoff timeline. That trade-off-payment size versus lifetime interest-is the core decision with 15 yr refi rates.

How rates are set

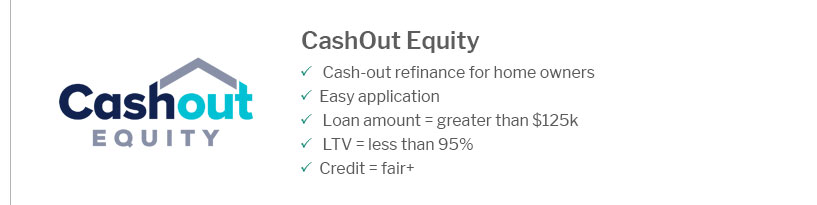

Lenders price these loans based on credit score, loan-to-value, points, occupancy, and whether the loan is conforming or jumbo. Broader market forces-inflation, bond yields, and expectations for the Fed-also shape the rate you’re offered. A lower rate isn’t always cheaper if fees are high, so weigh the APR alongside the note rate.

Who benefits-and who might not

Borrowers with steady income, solid equity, and a goal to be debt-free sooner often gain the most. If cash flow is tight or you plan to move soon, the higher payment and upfront costs can outweigh savings.

- Compare rate vs APR and lender fees

- Evaluate points and break-even time

- Check prepayment flexibility

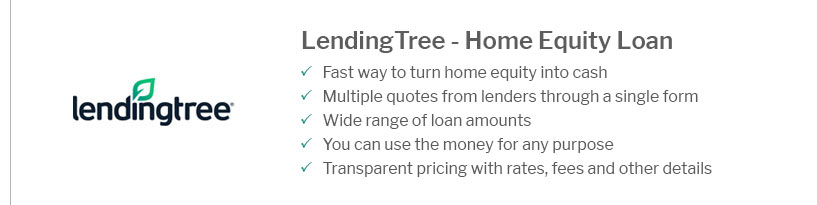

- Confirm cash-out impacts pricing

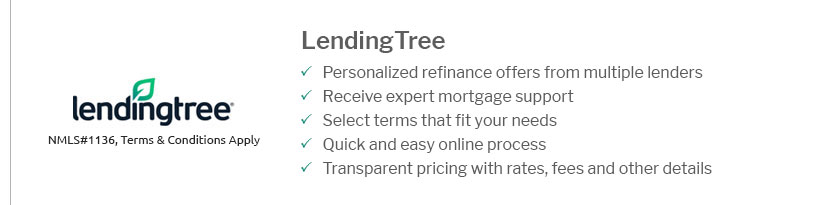

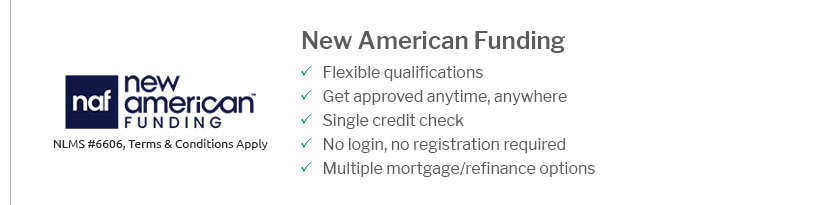

- Shop multiple quotes the same day